46+ do multiple mortgage applications hurt credit

Web Credit-scoring models can account for rate shopping in the way they calculate your credit scores. Web Within a 45-day window multiple credit checks from mortgage lenders are recorded on your credit report as a single inquiry.

How Many Points My Credit Score Dropped After Multiple Mortgage Applications Youtube

Check Your Official Eligibility Today.

. Web They also can include a record of you requesting your own report and requests for employment purposes. Web Applying for a mortgage. However applying with too many lenders may result in score-lowering.

Take the First Step Towards Your Dream Home See If You Qualify. Web Having multiple offers in hand provides leverage when negotiating with individual lenders. Your credit score might take an initial hit when you apply for a mortgage because the lender will have to open up a hard inquiry into your.

Web Yes it does matter. Web Applying for a loan or credit card with multiple lenders at one time can be a risky approach to take as it could affect how you are viewed as a borrower in the future. Compare Loans Calculate Payments - All Online.

Web Credit bureaus are aware that potential borrowers will rate shop so you generally have between a 14- to 45-day window depending on which credit bureau where all pulls are. This can indicate financial trouble. Web Its important to know that when you apply for a mortgage the lender often makes a hard inquiry on your credit report which gives the lender detailed access to your credit.

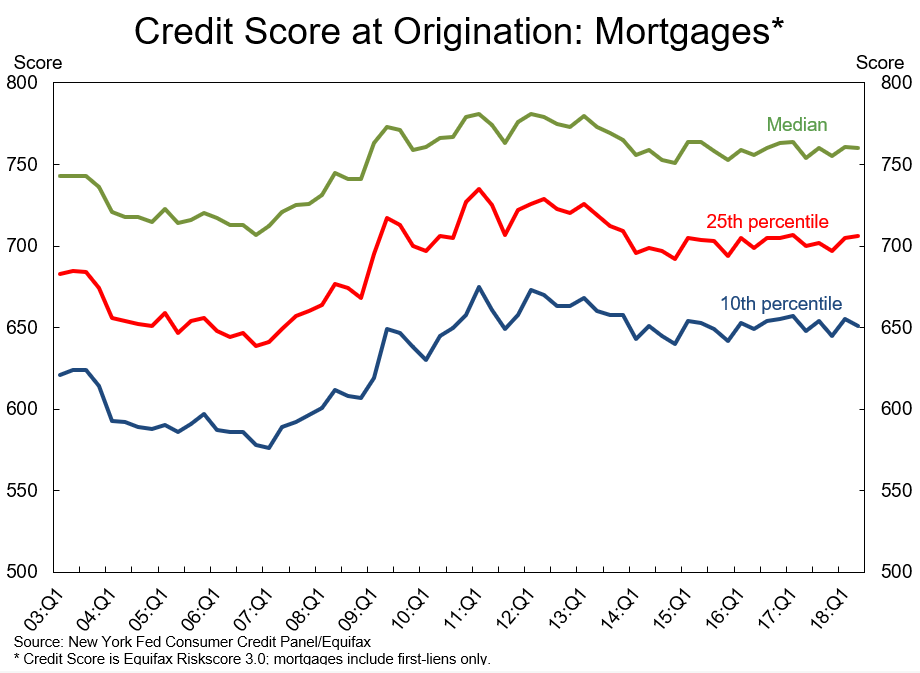

Ad Updated FHA Loan Requirements for 2023. Web A credit score of at least 620 is recommended and a higher credit score will qualify you for better rates. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

This is because other creditors realize. Web While recent inquiries can have some impact on credit scores that impact is typically small and temporary especially if your credit history is otherwise strong. Some credit-scoring models consider multiple inquiries.

Generally a credit score of 740 or above will enable most. Likewise VantageScore only allows a two. Web With FICO scores you actually have a 45-day window for rate shopping but some older FICO scores limit it to 14 days.

Ad Compare Home Financing Options Get Quotes. Historically speaking multiple credit inquiries within a short span of time are associated with greater risk. Web When you apply for a mortgage working with two or more lenders at once can help you find the best deal.

Choose The Loan That Suits You. Get All The Info You Need To Choose a Mortgage Loan. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web Applying for a loan can temporarily knock a few points off your credit score. Many or all of the products featured here are from our partners who compensate us. Apply Online Get Pre-Approved Today.

Because they are not the result of a credit application soft. Ad Compare Best Mortgage Lenders 2023. When shopping for a.

Web While multiple loan applications can be treated as a single inquiry in your credit score even that single inquiry can cause your credit score to drop. Web Credit reporting companies recognize that many people shop around for a mortgage so even if a lender uses a hard credit check for your pre-approval there. However what you dont want is to end up paying.

Does Applying With Multiple Mortgage Lenders Affect Credit Score

Does Applying With Multiple Mortgage Lenders Affect Credit Score

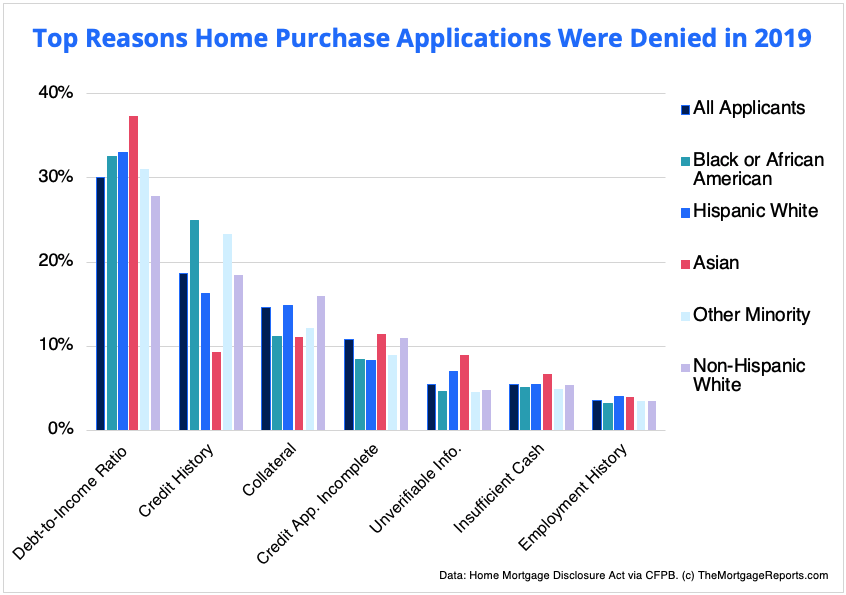

Mortgage Denial Stats By Race What We Can Learn Mortgage Rates Mortgage News And Strategy The Mortgage Reports

2023 Us Mortgage Market Statistics Home Loan Originations By State

Mortgage Credit Rises As More Lower Score Loan Products Offered Asset Securitization Report

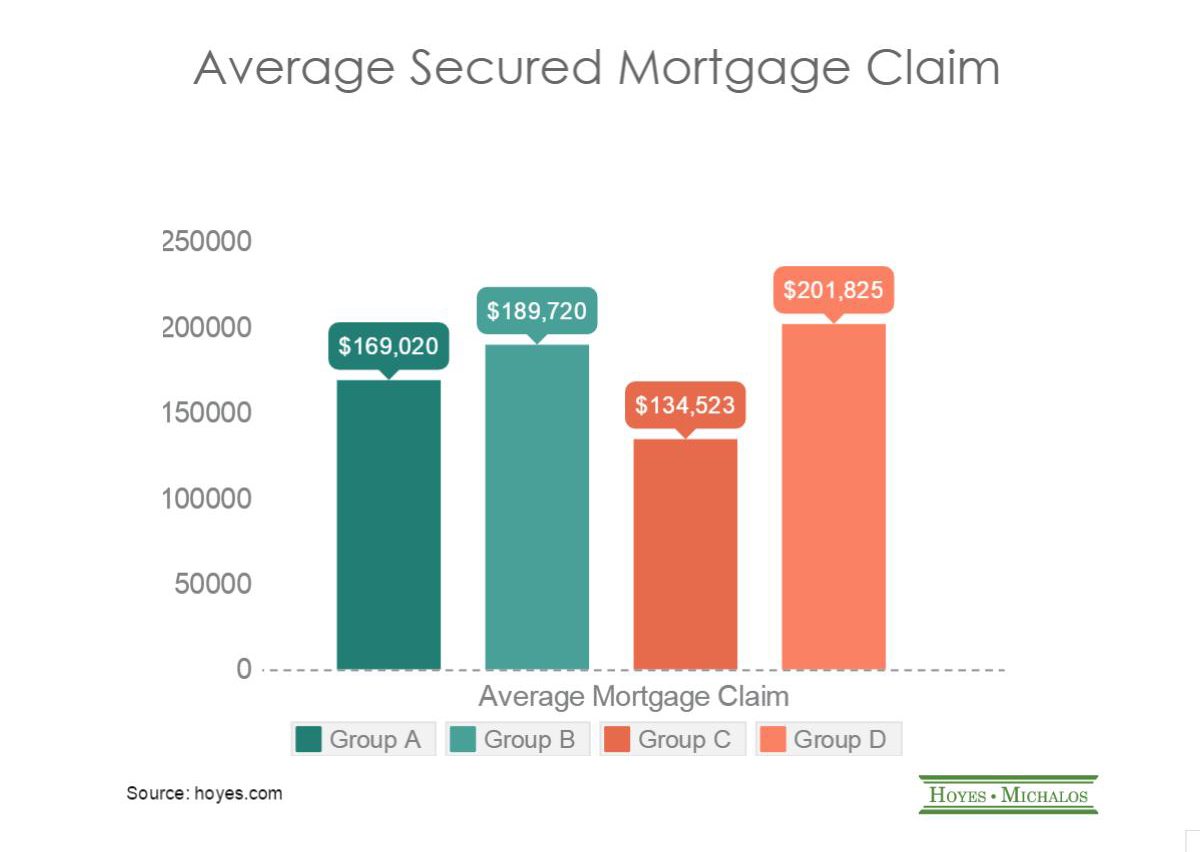

Does The Mortgage Lender You Choose Matter Hoyes Michalos

Reader Q Do Multiple Mortgage Searches Affect Your Credit Score Money To The Masses

How Multiple Loan Applications Can Affect Your Customer S Credit Score Credit For Comfort

:max_bytes(150000):strip_icc()/GettyImages-1217480775-d881ec5b3fd5485dadf300ef05a36d3e.jpg)

How Does A Mortgage Affect Your Credit Score

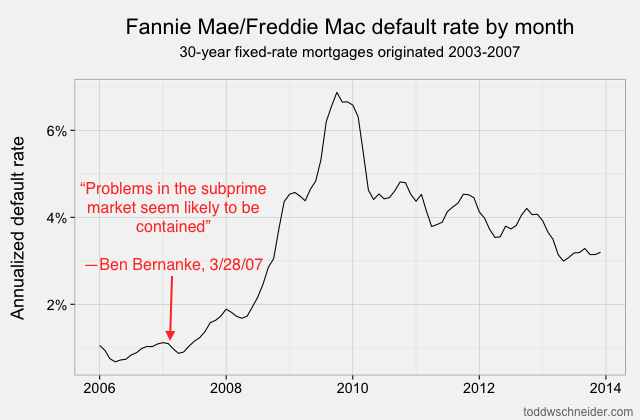

Mortgages Are About Math Open Source Loan Level Analysis Of Fannie And Freddie Todd W Schneider

Does Shopping Around For A Mortgage Hurt Your Credit Score

Mortgage Declined Here S What To Do Next Homeowners Alliance

Why Are Mortgage Applications Declined Mortgage Plus Credit Score

How Many Times Can You Pull Credit For A Mortgage

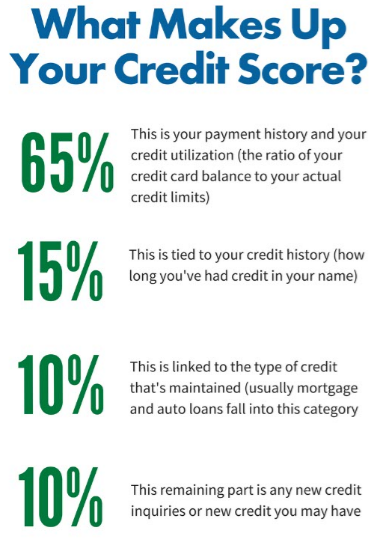

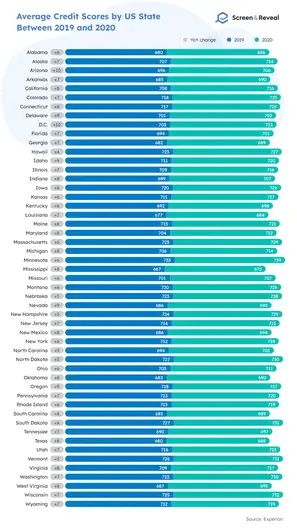

46 Credit Score Statistics And Faqs For 2022 Screen And Reveal

Fhfa S Stats On Mortgage Loan Performance In 2020 Dsnews

46 Credit Score Statistics And Faqs For 2022 Screen And Reveal